The Families First Coronovirus Response Act (FFCRA) was passed by Congress and goes into effect on April 1, 2020, and will sunset on December 31, 2020.

There are two components of the legislation:

- Emergency Paid Sick Leave Act

- Emergency Family and Medical Leave Expansion Act (ER-FMLA)

Emergency Paid Sick Leave Act

- Private employers with fewer than 500 employees

- A public agency or other non-private entity with at least 1 employee

- Full and part-time – No hours of service requirements

- Leave Period: 80 hours a week for Fulltime employees/Number of hours worked on average over a 2-week period for Part-time Employees

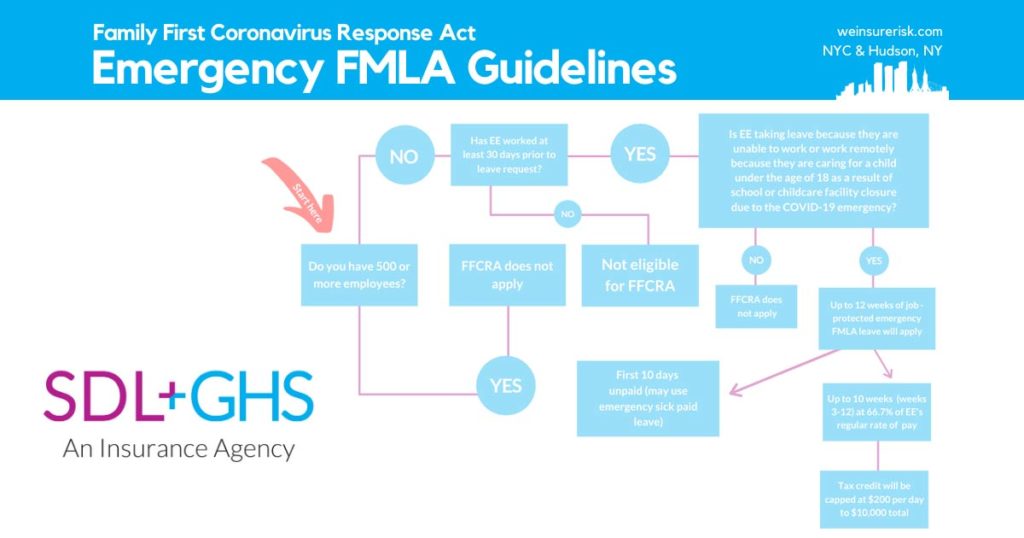

Emergency Family and Medical Leave Act

- Private employers with fewer than 500 employees

- A public agency or other non-private entity with at least 1 employee

- Employees must have worked 30 calendar days

- No hours of service requirements

- No requirement for a minimum of 50 employees in a 75-mile radius (unlike standard FMLA)

- Leave Period is 12 weeks (2 weeks unpaid and 10 weeks paid)

An employee can apply for leave based on their own illness, a family illness or a reason for school closure. How do I know if my employee is eligible for one of these benefits? Find easy to follow flowcharts:

Emergency FMLA Guidelines [PDF]

Emergency Paid Sick Leave Guidelines [PDF]

Employers will have the opportunity to reimburse themselves for approved paid leave, using a combination of payroll taxes & reimbursements from the Federal Government. Find out details on the act here:

(NEW) DOL-Families First-Employer Expanded FMLA Requirements [PDF]

243616 IRS Issues Guidance on Tax Credits for Coronavirus (COVID-19) Paid Leave [PDF]

Families First Coronavirus Response Act – Questions and Answers [PDF]